The Complete Guide to Programmatic Advertising in APAC Markets

Introduction

Programmatic advertising in APAC has entered a new era. No longer just an efficiency tool, it is now the backbone of digital media planning, accounting for the majority of ad spend across the region.

In 2025, digital ad spend in APAC is forecast to grow 5.8% YoY, outpacing global averages, with programmatic capturing more than 80% of digital transactions by 2026 (dentsu Ad Spend Forecast, June 2025). What sets APAC apart is not only its size, with over $300B in ad spend, but also its diversity. China, India, Southeast Asia, Australia, Japan, and South Korea each bring unique ecosystems, regulations, and consumer behaviors.

This guide offers a comprehensive, insight-driven perspective on programmatic advertising in APAC, featuring updated data, regional insights, challenges, opportunities, and a strategic playbook for advertisers.

APAC Programmatic Market: 2024–2025 Snapshot

- Market Size (2025): $300B+ in ad spend across APAC

- Programmatic Share: >80% of digital ad transactions expected by 2026

- Top Drivers: Mobile-first consumption, retail media, connected TV (CTV), AI-led automation

- Regional Leader: China still dominates, but India and Southeast Asia are the fastest-growing

Country-Level Insights

China: The Giant with Local Walled Gardens

- Platforms like Douyin, Tencent, Baidu, and Tmall dominate.

- AI-powered personalization and retail media are critical growth areas.

- Challenge: PIPL data regulations limit cross-border targeting.

India: Mobile-First, Video-Heavy Growth

- India is becoming a hotspot for programmatic advertising in APAC.

- CTV through JioCinema and Hotstar is exploding.

- Regional-language video is the fastest-growing ad format.

Southeast Asia: Fastest-Growing Digital Market

- 6.8% ad spend growth in 2025 (Dentsu).

- Super apps like Grab and Gojek integrate ads across transport, food, and payments.

- Indonesia and Vietnam are key mobile-first markets.

Australia: Privacy-First and Premium-Focused

- Early adoption of retail DSP integrations, though only 9% of brands use them fully.

- Premium publishers and transparency drive trust.

Japan & South Korea: Tech-Forward Innovators

- Heavy investment in AI-driven predictive targeting.

- 5G connectivity drives mobile video and gaming ads.

- Experimentation with AR/VR programmatic pilots.

Key Trends in Programmatic Advertising in APAC

1. Connected TV (CTV)

- CTV ad spend grew 128% YoY in 2024 across APAC (Pixalate).

- Partnerships like Netflix x The Trade Desk are unlocking scale.

- Risk: CTV invalid traffic (IVT) rates at 36% in APAC (2025) demand strict fraud prevention.

2. Retail Media

- Fastest-growing channel in APAC, forecast at 10% CAGR through 2031.

- Platforms like Shopee, Lazada, Flipkart, and Tmall are central to consumer journeys.

- First-party commerce data is becoming more valuable than cookie-driven targeting.

3. AI & Super Apps

- AI-driven discovery is overtaking traditional search ads, with predictive placements inside WeChat, Gojek, and Grab.

- Search ad growth slowed to 3.9% in 2025, while AI-powered display and retail surged.

4. Programmatic DOOH (prDOOH)

- Global prDOOH spend forecast at $17.6B in 2025 (+14.9% YoY).

- APAC’s dense cities (Tokyo, Singapore, Seoul, Jakarta) make DOOH impactful.

- Expect DOOH + mobile retargeting bundles to become mainstream.

Challenges of Programmatic Advertising in APAC

1. Fraud & Invalid Traffic

- CTV IVT rates in APAC remain the world’s highest at 33–36%. App install fraud is especially prevalent in India, Vietnam, and Indonesia. For a deeper look at how automation can sometimes undermine efficiency, see GeoSpot’s guide on Problematic Programmatic: When Automation Undermines Advertising

2. Regulation & Privacy

- China (PIPL): Cross-border restrictions.

- India (DPDPA): Data localization rules in effect.

- Japan, Korea, Singapore: Differing consent requirements.

3. Market Fragmentation

- No single DSP dominates. Brands must partner with global and local platforms.

4. Measurement Gaps

- Lack of unified metrics across APAC.

- Brands are building in-house attribution models for consistency.

Strategic Playbook for Success in APAC

1. CTV: Scale Smartly

- Prioritize Premium Inventory:

- Focus CTV ad spend on high-quality, reputable publishers and platforms to ensure brand safety and maximize audience engagement.

- Regularly audit inventory sources to avoid low-quality placements and maintain campaign effectiveness.

- Partner with Verification Vendors to Reduce Fraud Risk:

- Collaborate with trusted third-party verification partners to monitor and filter out invalid traffic (IVT) and ad fraud, which are prevalent in APAC CTV markets.

- Implement real-time fraud detection tools and demand transparency from all supply partners.

2. Retail Media: Go Beyond Performance

- Integrate Brand-Building and Commerce Outcomes:

- Design campaigns that drive immediate sales while building long-term brand equity within retail media environments. Use a mix of upper-funnel (awareness) and lower-funnel (conversion) tactics to maximize impact.

- For more strategic insights on optimizing programmatic campaigns, check out GeoSpot’s guide on Top Programmatic Media Buying Strategies for 2025.

- Leverage DSP Integrations for Efficiency:

- Utilize demand-side platform (DSP) integrations with major retail media networks to streamline campaign management and optimize bidding strategies.

- Take advantage of first-party data from retail partners to enhance targeting and personalization.

3. AI-Led Targeting

- Move from Manual Segmentation to Predictive AI-Driven Placements:

- Shift from static audience segments to dynamic, AI-powered targeting that predicts user intent and optimizes in real time.

- Continuously test and refine AI models to improve accuracy and campaign ROI.

- Use Generative AI for Dynamic, Localized Creative:

- Employ generative AI tools to automatically create and adapt ad creatives for different languages, regions, and cultural contexts within APAC.

- Personalize messaging at scale to increase relevance and engagement.

4. Localization Above All

- Regional-Language Ads in India and SEA Boost ROI:

- Develop ad creatives in local languages and dialects to connect authentically with diverse audiences in India and Southeast Asia.

- Test and measure the performance of localized campaigns versus generic English-language ads.

- Partner with Local Agencies and DSPs for Cultural Alignment:

- Collaborate with agencies and DSPs that have deep knowledge of local consumer behavior, regulations, and media landscapes.

- Leverage their expertise to tailor campaigns for each market’s unique nuances.

5. Measurement Standardization

- Define Internal APAC KPIs Across Countries:

- Establish a consistent set of key performance indicators (KPIs) that can be tracked across all APAC markets, allowing for meaningful comparison and benchmarking.

- Align measurement frameworks with business objectives and local market realities.

- Use Multi-Touch Attribution to Track Across Mobile, CTV, and DOOH:

- Implement advanced attribution models that capture the full customer journey across multiple channels, including mobile, connected TV, and digital out-of-home (DOOH).

- Use these insights to optimize budget allocation and improve overall campaign effectiveness.

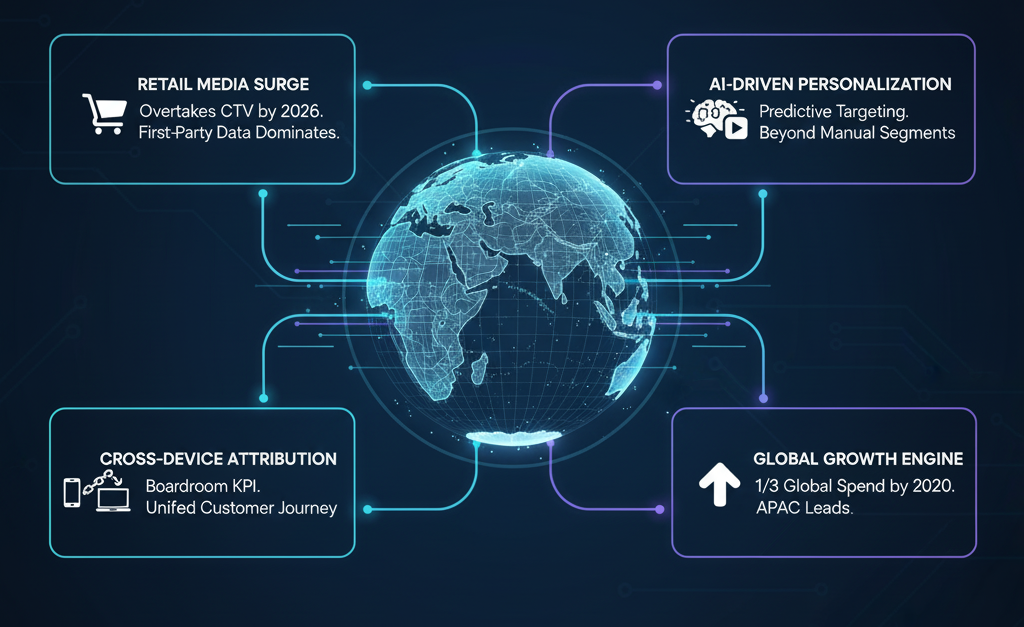

The Future of Programmatic in APAC

- By 2026, retail media may overtake CTV as the biggest incremental spend channel.

- AI-driven personalization will replace manual targeting.

- Cross-device attribution will become a boardroom KPI.

- By 2030, APAC could account for one-third of global programmatic spend.

The takeaway: APAC is not an “emerging” opportunity-it’s the engine of global programmatic growth.

Conclusion

The APAC programmatic advertising market is evolving rapidly, shaped by CTV adoption, retail media ecosystems, super app dominance, and AI-powered personalization. But the path forward is complex: high fraud rates, fragmented markets, and regulatory hurdles demand smarter strategies.

For marketers, success in APAC comes from:

- Localization (language, culture, platforms).

- Data-driven, AI-powered targeting.

- Privacy-by-design campaigns.

Those who adapt quickly will unlock APAC’s vast scale and lead in the next wave of programmatic innovation.

👉 Schedule a demo to see how our programmatic solutions can scale across APAC.